Florida’s home insurance market has faced significant challenges for years. Many of these problems came from loopholes that hurt Florida. Because of these gaps, insurance companies and homeowners suffered together. Fraudulent claims became common, and premiums soared. Before recent reforms, the entire system teetered on the brink of collapse. Understanding what happened before the changes helps everyone see why reform was so urgently needed. Now, Florida serves as a cautionary tale for other states. The story reveals how even minor legal oversights can have significant consequences. Let’s explore the roots of Florida’s insurance crisis and how reforms are shaping the future.

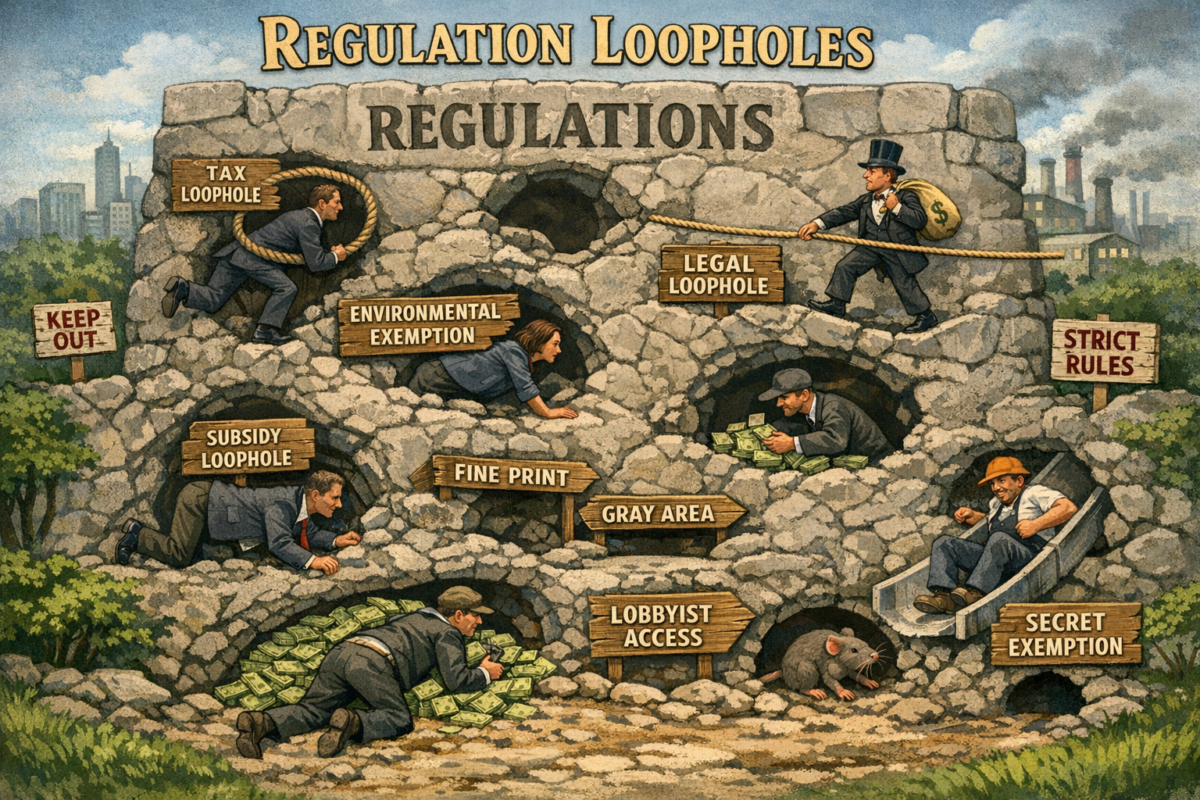

Understanding Legal Loopholes in Florida Insurance Law

First, legal loopholes in Florida’s insurance system allowed people to take unfair advantage. For years, specific clauses in contracts gave third-party contractors too much power over claims. As a result, some contractors could sign over policy rights and take over the entire claims process. Although this seemed like a quick fix for homeowners, it opened the door to abuse.

Furthermore, many laws did not clearly define limits on legal fees. Because of these unclear rules, lawyers and contractors often filed lawsuits for even small claims. Insurance companies struggled to defend themselves against so many legal battles. Meanwhile, loopholes made it hard for insurers to deny suspicious claims. When loopholes allowed lawsuits to multiply, everyone involved felt the strain. Loopholes hurt Florida’s home insurance

Additionally, confusion over “assignment of benefits” agreements grew. Homeowners often did not realize they were signing away control of their policies. As loopholes went unchecked, fraudsters found new ways to exploit honest homeowners. Since the law offered little protection, both insurers and customers found themselves trapped by legal technicalities. Over time, trust in the system faded as loopholes led to increasingly serious problems.

The Rise of Fraudulent Claims and Their Impact

Once loopholes became common knowledge, fraud surged across the state. Shady contractors began targeting neighborhoods after storms, promising free repairs to anyone willing to sign over their policy rights. Because the assignment-of-benefits process was poorly regulated, these contractors could inflate repair costs. Insurers then faced bills that far exceeded the actual value of the damage.

Not only did fraudulent claims overwhelm insurance companies, but they also affected honest homeowners. When insurers paid out for fake or exaggerated claims, their losses piled up. To stay in business, companies had to recover by raising everyone’s premiums. As a result, families who never filed a claim still paid the price. The rise in fraud made it harder to find affordable coverage.

Moreover, the legal environment favored lawsuits over cooperation. Because lawyers could collect high fees for even small wins, many cases ended up in court. As lawsuits increased, insurers spent more money defending themselves than helping real victims. Fraud became so widespread that some companies left the market altogether. Without substantial reforms, the entire system risked collapse.

How Loopholes that Hurt Florida’s Home Insurance Exploded Premiums Statewide

Insurance premiums in Florida skyrocketed in recent years. As fraud and lawsuits multiplied, companies faced more risk with every policy they wrote. To offset these risks, insurers had no choice but to charge higher rates. In turn, families across the state saw their premiums double or even triple almost overnight.

Because the legal system made it easy to file lawsuits, insurers spent huge sums on legal fees rather than on claims. Each time a company lost a case, other policyholders ended up paying for it through their premiums. Homeowners who never filed a claim still saw their costs rise year after year. While some people tried to shop around, few found any relief.

Eventually, many insurance companies left Florida entirely. When competition shrank, the remaining companies could raise rates even further. Some homeowners could no longer afford insurance. Others risked losing their homes because their policies were canceled. High premiums became a daily burden for families already struggling with rising costs elsewhere.

The Struggles Homeowners Faced Before Reforms to Loopholes that hurt Florida home insurance

Before reforms were passed, Florida homeowners faced a perfect storm of difficulties. Many received confusing paperwork after storms, only to later discover they had signed away their policy rights. Contractors sometimes filed claims without even starting repairs. For honest families, navigating the system was nearly impossible.

In addition, rising premiums forced many people to cut back elsewhere. Some families had to choose between home insurance and other basic needs. Others faced foreclosure because lenders required insurance that they simply could not afford. Even those who paid high premiums worried that their claims might be denied if another storm hit.

Worse yet, the lack of trust created tension between homeowners and insurers. People felt trapped, knowing they needed coverage but unsure whom to trust. When fraudsters moved in, neighborhoods became battlegrounds for legal fights and repairs. Without reforms in place, hope seemed far away for Floridians just trying to protect their homes.

Turning Point: Major Reforms Change the Landscape For Loopholes that hurt Florida home insurance

Finally, lawmakers took bold action to fix the broken system. The change came in the form of new restrictions on assignment of benefits agreements. Contractors and lawyers could no longer take over claims without explicit permission. Homeowners now have more control over their own policies.

In addition, the legal landscape shifted to discourage frivolous lawsuits. New rules limit the fees lawyers and contractors can collect from insurance companies. Because of these reforms, insurers no longer face the same overwhelming risk from small claims and the . Fewer lawsuits mean more resources go toward real repairs rather than court battles.

Early signs show that the reforms are working. Fraudulent claims have dropped, and insurers are returning to the Florida market. Premiums are stabilizing, giving families hope for the future. With stronger oversight, the entire system seems more balanced. Homeowners now have better protection from both fraud and sky-high costs.

Lessons Learned and the Path Forward for Florida

Looking back, Florida’s experience offers important lessons for everyone. First, even well-meaning laws can cause harm if loopholes that hurt Florida home insurance go unaddressed. When contractors and lawyers work around the rules, the entire insurance system feels the impact. Protecting homeowners means keeping laws clear and closing any gaps that might lead to abuse.

Furthermore, the crisis showed that fast action matters. Once fraud took hold, it spread quickly and affected everyone. By taking strong steps, lawmakers restored balance and rebuilt trust. The reforms did not solve every problem, but they stopped the worst abuse. Now, other states are watching Florida’s progress and learning from its mistakes.

Florida’s path forward depends on continued vigilance. Lawmakers and regulators must closely monitor the system, ready to act if new loopholes emerge. Homeowners also need clear information to make wise choices about their coverage. Insurers and contractors should work together to rebuild trust in the market. By focusing on honesty and transparency, Florida can protect its families and homes for generations to come. The state’s journey reminds everyone that strong laws, innovative reforms, and community awareness are the keys to a healthy insurance market.

In Summary

Florida’s home insurance crisis did not happen overnight. Years of unchecked loopholes, rising fraud, and legal battles eroded the market’s stability and loopholes hurt Florida’s home insurance. Homeowners paid the price through higher premiums and endless confusion. Once lawmakers stepped in, real change became possible. The new reforms are a turning point, providing hope that Florida can finally leave its insurance troubles behind. Although challenges remain, the state now has stronger tools to fight fraud and protect policyholders. Families can begin to trust the system again, knowing that the law is on their side. As Florida looks forward, its hard-won lessons offer a roadmap for others. With clear rules, strong oversight, and honest partnerships, everyone can enjoy safer, more affordable coverage. The story of Florida’s reforms shows how determined action can heal even the deepest cracks in a broken system.